GOP’s American Healthcare Act anti-health, anti-care, anti-American

Shane Fender

The American Health Care Act of 2017 (AHCA) passed the House of Representatives after a series of amendments allowed for the bill in its new form to gain a majority by the narrowest of margins.

The AHCA will throw millions off of insurance and give billions of dollars in tax breaks to the wealthiest Americans over the next decade; however, the majority of De Anza students will be unaffected.

De Anza students are approximately 75% age 26 and younger according to recent De Anza enrollment and census data, students will be able to remain on their parent insurance until the age of 26 as was put in place by the ACA in 2010.

Unfortunately, most students’ families, estimated at 70%, have household incomes below the arbitrary line that would be negatively impacted by the AHCA as proposed today.

Fundamentally, states would have the option to decide to weaken or eliminate what is considered essential health benefits that, given the protections by Obamacare, limit annual out of pocket expenses for the enrollee and prevent insurers from imposing yearly or lifetime price caps on what they would cover.

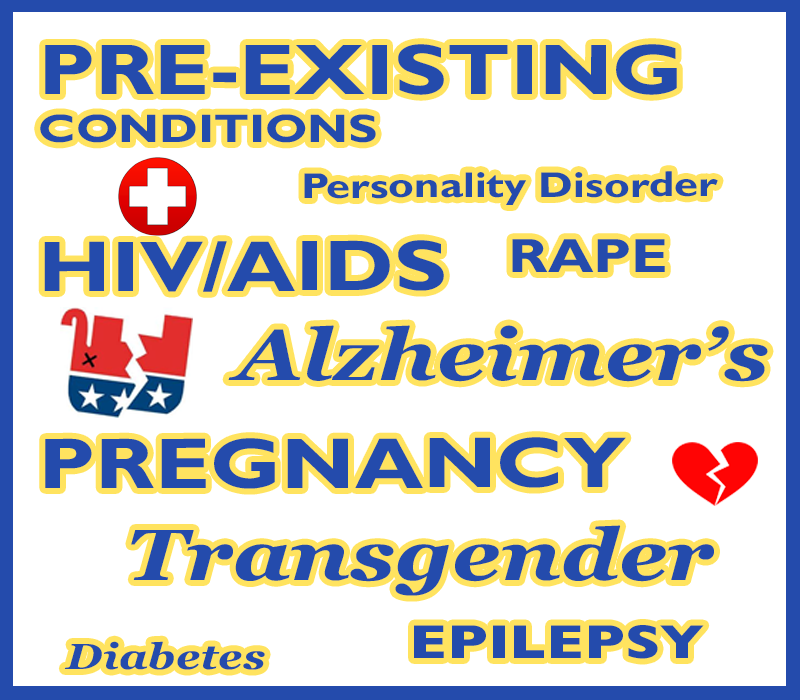

Were California to opt out of Obamacare’s protections against pre-existing condition discrimination, students with pre-existing conditions will be the ones who will take one of the greatest financial hits.

Our state making this choice ”means insurers could once again discriminate against people based on their medical history. Insurers could increase premiums by unlimited amounts for people with a history of cancer, hypertension, asthma, depression, or other conditions,” According to Center on Budget and Policy Priorities.

In states that waived essential health benefits and in the major employer-provided plans, changes will also have an adverse impact on students with disabilities by reintroducing annual and lifetime caps on coverage.

In a purely financial sense, the AHCA would decrease the deficit by approximately 350 Billion dollars over 10 years while at the same time reducing taxes by almost a trillion dollars for the wealthiest Americans over the same period.

Obamacare tax provisions being revoked would shift the benefits of this legislation from the poor to the rich and the old to the young, although exact numbers are not known.

In fact, were the AHCA to pass, after 2020, this would have a positive financial effect on the majority of young adults who are healthy, don’t have pre-existing conditions and aren’t in need of maternity care.

The bill is now heading to the Senate where it will be subject to further alterations before being put to a vote. As a budget resolution, this only requires a simple majority to pass.